Re-exporting Armenia: Why Has the Foreign Trade Landscape Changed?

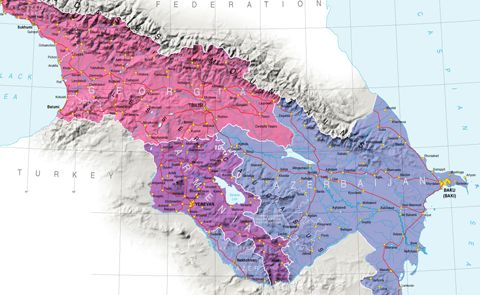

Western sanctions imposed on Russia have turned Armenia into a re-exporter and transit country for trade in Russian and Western goods. The Russia-Ukraine conflict, which began in 2022 and is now approaching its third year, has had a direct impact not only on the global economy and politics but also on the South Caucasus region. This influence is felt in both the security system and the economy. The indirect consequences of the conflict have affected Armenia’s foreign trade, resulting in a drastic shift in the structure of Armenia’s foreign trade turnover. Armenia has become a transit country for trade between Russia and Western countries.

In 2022, exports from Armenia to Russia amounted to $2.4 billion, which is 2.9 times higher than in 2021. This shift alters the longstanding economic relationship between Armenia and Russia, as export volumes from Armenia to Russia in 2022 have nearly equaled total trade volumes from previous years.

According to Armenia’s Customs Service, exports from Armenia to Russia in 2023 reached almost $3.6 billion. This statistic might not raise so many questions if the exported goods were produced in Armenia. For years, Armenian brandy—a signature product for Armenia—has held significant weight in Armenian exports. However, an analysis of Customs Service data shows that the majority of exported goods are actually imports that Armenia received from other countries. As a result, it appears that Russia has found a way to bypass Western sanctions by utilizing Armenia’s economic space.

Armenia’s High-Tech Sector May Face Setbacks

According to Professor Atom Margaryan from the Armenian State University of Economics, Western sanctions imposed on Russia are not solely due to the Russia-Ukraine war. He believes that the war is a consequence of the ongoing global conflict between Western powers and emerging nations like China and Russia. He suggests that technological competition lies at the root of the Russia-Ukraine conflict.

“Regarding the sanctions on EAEU member countries, yes, some countries, including Armenian organizations, are under such sanctions, and this list could expand. Particularly, high-tech products—such as smartphones, computers, and equipment—reach Russia via Armenia, Kazakhstan, and other countries. There are always ways to bypass such restrictions,” explains the expert.

He recalls that since the 1970s, the U.S.-Soviet conflict manifested in the Jackson-Vanik restrictions, which prohibited the export of advanced Western technologies to the Soviet Union, stalling its potential technological and especially military developments. “I see a similar element in today’s restrictions, which could impact Armenia’s high-tech sector and businesses engaged in re-export. Jewelry remains a key export, but high-tech products also play a large role. The Armenian economy, in this sense, is suffering, and it will suffer more as trade volumes increase,” Margaryan asserts.

He further explains that Western powers and donor organizations, such as the World Bank, International Monetary Fund, and International Development Bank, have leverage over Armenia and could pressure Armenian authorities to align with these restrictions. Margaryan suggests that if Armenia were financially self-sufficient and able to address budgetary issues independently rather than relying on massive foreign loans, the situation might not be as severe.

Products Not Produced in Armenia but Exported

A significant part of Armenia’s exports includes electronics such as computers, mobile phones, and televisions. In 2022, Armenia exported $70 million worth of computers to Russia, a significant increase from just $1.6 million in 2021. Mobile phone exports rose sharply as well, from $188,000 in 2021 to $251 million in 2022. Armenia imports these products from various Western and Asian countries. Re-exporting Western goods banned for export to Russia could potentially expose Armenian businesses to Western sanctions, thereby posing a risk to Armenia's economy.

Another major product that Armenia does not produce but exports in large quantities is automobiles. According to data from the Customs Service in 2023, Armenia exported around $484 million worth of passenger cars, almost double the previous year’s figure, while it imported $1.3 billion worth of cars in the same period.

Interestingly, to bypass Western sanctions, Russia has utilized not only its strategic partner Armenia but also neighboring Georgia, despite their strained relationship. However, in response to the surge in car shipments from Armenia and Georgia to Russia, Georgia implemented legislative changes, banning the export of Western-made cars to Russia and Belarus via Georgian territory from August 1, 2023. Following these changes, Armenia’s car exports to Russia saw a sharp decline.

The most notable export remains the re-export of precious stones and metals, particularly gold and diamonds. In December 2023, Armenia produced approximately 22,580 kg of jewelry valued at $203 million—a 9.4-fold increase from the same month in the previous year, a trend observed over the past decade. The Statistical Committee later reclassified this output under the basic metals category.

An investigation by the Investigative Journalists NGO of Armenia suggests that this jewelry may actually be gold imported from Russia, processed, and then re-exported as Armenian-made jewelry or semi-finished items. This conclusion was reached after examining the activities of Neltax Holding LTD, an offshore company registered in the Seychelles. The company’s sole shareholder is Alexey Spirikov, a Russian citizen from Vladimir. In 2023, Neltax Holding LTD was identified in schemes involving the import of gold from Russia to Armenia and subsequent export of jewelry and gold items from Armenia to the UAE.

Besides jewelry, Armenia also re-exports raw or semi-processed gold. According to the Customs Service, in 2023, Armenia exported $1.8 billion worth of gold, an unprecedented amount in the country’s history. Data shows that Armenia imported this gold from Russia and primarily exported it to the UAE.

Amberd Research Center’s expert, Aghasi Tavadian, expresses concern that while re-exports bring short-term revenue to Armenia, they pose risks of medium-term economic downturn. He highlights the rapid increase in re-exports, particularly in high-value items like gold and diamonds, largely sourced from Russia and sent onward to the UAE and China. According to Tavadian’s estimates, while official reports placed re-exports at 4%, Amberd’s research suggests it comprised 6% of Armenia’s $3 billion exports in 2021, 26% of $5.4 billion in 2022, and a striking 48% of $8.4 billion in 2023. Tavadian projects that re-exports could account for 65-70% of a forecasted $13 billion in exports for 2024—a trend he sees as dangerous for Armenia’s economy.

Tavadian is particularly concerned about Armenia’s heavy reliance on re-exporting precious metals and stones, which made up 71% of exports in the first half of 2024. With Russia constrained in accessing financial resources due to Western sanctions, gold can serve as a financial resource, making Armenia’s role in re-exports critical but risky.

While Armenia saw a 9.2% GDP growth in Q1 2024, Tavadian notes that about 4 percentage points of this growth came from gold re-exports alone. Following Amberd’s analysis, the government revised the actual growth to 6.6%. Additionally, in May 2024, Russia lifted an export tariff on gold, causing a subsequent drop in Armenia’s gold re-exports.

Tavadian cautions that Armenia won't retain these short-term gains, implying that the generated revenue is likely to leave the country. Rather than fearing Western sanctions, he advises that Armenia consider the long-term economic impacts, as its reliance on re-exports may ultimately harm sustainable growth and stability.

Contributed by Ani Grigoryan, the founder and editor of CivilNetCheck - a fact checking department at CivilNet online TV.

See Also

3+3 Initiative as a New Order in the South Caucasus

Economic Cooperation Between Armenia and Georgia: Potential and Challenges Ahead

Russia and Occupied Abkhazia: A New Type of Relations

Georgia and US: From Close Ties to Caution