Unveiling Armenia's Banking Boom: Factors Fueling Deposit Growth

This study investigates the substantial growth in banking deposits in Armenia from December 2021 to April 2024, analyzing the underlying factors and economic implications. The deposits attracted by Armenian commercial banks exhibited a compound monthly growth rate (CMGR) of 1.13% from December 2021 to December 2023 and reached 5.68 trillion Armenian drams (AMD) or 14.65 billion US dollars (USD) by April 2024 vs. 8.38 billion USD in December 2021. The appreciation of the Armenian dram against the US dollar did not deter the inflow of foreign currency deposits, mainly from non-residents, which peaked at 3.08 billion USD in 2022 before declining to 2.75 billion USD by December 2023. This period of growth was significantly influenced by external shocks, including the immigration of Russians due to the Russian-Ukrainian war and the displacement of ethnic Armenians from Nagorno-Karabakh. These demographic shifts contributed to an increase in resident and non-resident deposits.

Furthermore, the appreciation of the Armenian dram moderated the actual growth rate of deposits, which could have been 14.26 percentage points higher (vs actual growth rate of 17.52%) in 2022 without the currency appreciation. The research also explores potential future scenarios, considering the implications of Western sanctions on the Moscow Exchange (MOEX) and subsequent capital flows. The findings underscore the interconnectedness of geopolitical events and economic indicators in shaping the banking sector's performance in Armenia.

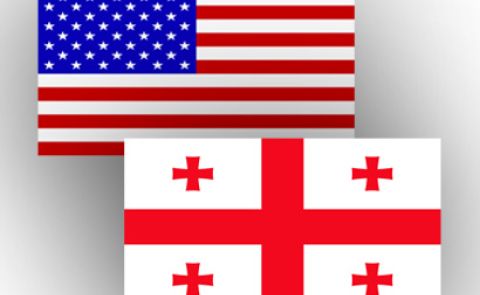

Background: From December 2021[1] to December 2023 the deposits attracted by the commercial banks of Armenia were growing at a compound monthly growth rate (CMGR) of 1.13%[2], and deposits made by both residents and non-residents amounted to 5.67 trillion Armenian drams (AMD) or 14.02 billion USD vs 4.02 trillion AMD (or 8.38 billion USD)[3] in December 2021[4] (including deposits in foreign currency)[5] (see Figure 1). Meanwhile, the CMGR of deposits by residents and non-residents comprised 1.02% and 1.51%. Despite the Armenian dram appreciating against the US dollar in 2022, commercial banks continued to attract foreign currency deposits, especially from non-residents. This did not lead many depositors to withdraw their foreign currency deposits and convert them to Armenian drams. Despite the Armenian dram appreciating against the US dollar by 18.03% in 2022 (year-over-year, end of period), non-resident deposits in US dollars increased from 1.46 billion USD at the end of December 2021 to 3.08 billion USD. This trend was reversed in 2023, and the deposits reported a decline in December 2023, comprising 2.75 billion US dollars. At the end of April 2024, the deposits made by both residents and non-residents reached 5.68 trillion Armenian drams (or 14.65 billion USD). Overall, the growth of the deposits could have been higher if the national currency had not appreciated against the US dollar. The deposits of the residents prevailed over the deposits of non-residents in the period 2021-2023 and accounted for about 24.7% of total deposits (28% in 2022). Only about 50% of deposits were in Armenian drams (45% in 2022), which means that both residents and non-residents were reluctant to make deposits in national currency, and even in the case of the relatively strong appreciation of Armenian dram against the US dollar (to convert the deposits and made them in national currency), highlighting a precautious attitude towards Armenian dram. The growth of deposits translated into higher indicators describing the banking system of Armenia, namely assets and capital.

Figure 1: The bank deposits by residents and non-residents (million Armenian Drams)

Source: Central Bank of Armenia

Factors explaining the growth: The growth was mainly driven by external shocks, although the economic growth translated into an increase in deposits made by residents as well. First, the immigration of Russians to Armenia upon the Russian-Ukrainian war in the first half of 2022, and the second wave of immigrants upon announcing the second wave of partial mobilization in September 2022. Second, the movement of forcefully displaced ethnic Armenians (more than 100,000 people) from Nagorno-Karabakh that started at the end of September 2023.

Moving of Russians to Armenia and other migrant workers: Russians started moving to Armenia in the first quarter of 2022 and continued in the second quarter, thus translating into a significant increase in bank deposits made by non-residents (both in Armenian drams and foreign currency) in the second quarter of 2022. At the end of June 2022, the deposits of non-residents made in foreign currency amounted to 1.83 billion US dollars (1.46 billion US dollars in December 2021), and the deposits in Armenian drams reached 199.25 billion (180.66 AMD in December 2021), (see Figure 1). In September 2022, when the partial mobilization in Russia was announced, it forced the citizens to flee Russia and move to other countries, with Armenia being among many, namely. This caused an additional increase in the deposits attracted by the commercial banks in September-October 2022 made by non-residents (in foreign currency), thus amounting to 3.14 billion US dollars at the end of October 2022. This trend was reversed in 2023, and at the end of December, deposits reached 2.75 billion US dollars, while the deposits made in Armenian drams increased. This could mean that immigrants, while moving to other locations (including Russia), withdrew their deposits (either partially or the full amounts with accrued interest) owing to the inability to withdraw in foreign currency, especially in Russia. The decline could have been even more significant if banks hadn't also attracted deposits from other migrant workers living in Armenia. Along with the decline in foreign currency deposits of non-residents, the deposits in the local currency increased substantially, reaching 245.60 billion AMD. This increase could be explained by the incentives program implemented by the Government of Armenia aimed at attracting the graduates of top-ranked (QS World University Rankings, top 400) universities to work at local companies and/or subsidiaries/branches and attracting migrant workers from India. At the end of April 2024, the non-residents' deposits (in foreign currency) reached 3.14 billion US dollars, while deposits in local currency comprised 244.21 billion AMD.

Movement of ethnic Armenian population from Nagorno-Karabakh to Armenia: The ethnic Armenians started moving to Armenia at the end of September until the first decade of October 2023. By fleeing, they took with them their savings and made bank deposits. Therefore, residents' deposits increased and reached 4.32 trillion Armenian drams at the end of December 2023 (3.69 trillion AMD at the end of December 2022), (see Figure 1). During four months of 2024, the Armenians fled from Nagorno-Karabakh, owing to their inability to find appropriate jobs (salaries compatible with the level they used to receive), started withdrawing their savings deposited in the commercial banks (even though the Government of Armenia was offering partial and/or full compensation for apartment rents and utility payments, and depending the district they were residing (and the number of household members), the compensation could have fully covered the rent, and utility bills). At the end of April 2024, the residents' deposits comprised 4.22 trillion Armenian drams. The decline was associated with withdrawing savings deposited in foreign and domestic currencies.

The growth effect associated with the shocks: The shocks translated into economic growth fueled by the growth in both external and domestic demands (for both goods and services, namely travel and IT-enabled services), enabling both the resident households and private companies to make more deposits in the commercial banks[6]. This caused an increase in residents’ deposits in commercial banks amounting to 3.69 trillion AMD (including deposits in foreign currency) at the end of December 2022, compared to 3.14 trillion AMD in December 2021 (see Figure 1). Before the influx of ethnic Armenians from Nagorno-Karabakh, the deposits amounted to 4.06 trillion Armenian drams (at the of August 2023), and they might have continued to report an increase, although at a slower pace. Overall, the deposits would have reported growth slower, due to the recovery of the economy (including recovery in the leading trade partners of Armenia) after the aftermath of the COVID-19 pandemic. Based on the authors’ estimation results (time-series estimation technique), without the movement of Russian immigrants to Armenia after the Russian-Ukrainian war, the deposits could have reached about 4.6 trillion Armenian drams at the end of December 2022, vs the actual about 5.1 trillion AMD, or lower by about 0.5 trillion AMD. In December 2023, without the movement of Russian immigrants and ethnic Armenians of Nagorno-Karabakh, the deposits could have grown and reached about 5 trillion AMD vs the actual about 5.7 trillion AMD or about 0.7 trillion AMD less than the actual value.

The impact of exchange rate on the deposits: The growth of the deposits attracted by the commercial banks of Armenia could have been even stronger if the Armenian dram had not appreciated against the US dollar (see Table 1). The real growth of deposits at the end of December 2022 comprised 17.52% compared to December 2021. However, the real growth could have reached 31.78% if the Armenian dram had not appreciated by 18.03%[7], or higher by 14.26 percentage points than the reported growth rate. In 2023, the growth slowed, and compared to December 2021, the real growth of deposits amounted to 31.06% at the end of December, 12.32 percentage points lower than it could have been reported (based on the re-evaluation).

Table 1.: Real growth rates of deposits vs foreign exchange volatility re-valuated real growth rates of deposits

Date | Real Deposits, real (million AMD) | Real growth rate (%) | Real Deposits, re-valuated based on the foreign exchange volatility (million AMD) | Real growth rate (%) based on the re-evaluation |

31/12/2021 | 4,024,616 | - | 4,024,616 | - |

31/12/2022 | 4,729,873 | 17.52% | 5,303,593 | 31.78% |

31/12/2023 | 5,274,658 | 31.06% | 5,770,531 | 43.38% |

30/04/2024 | 5,239,664 | 30.19% | 5,868,618 | 45.82% |

Note: 31/12/2021=100. Authors’ calculations

Possible Development Scenarios: Based on the estimation results at the end of December 2024 (y/y) a decline could be reported, and the deposits would amount to about 5.5 trillion Armenian drams. However, owing to the Western sanctions, namely concerning the Moscow Exchange (MOEX) that became effective on 12 June 2024 the Russian rubble could depreciate against the Armenian dram (even a deep depreciation could be reported) in the second half of 2024, thus causing difficulties for those industries that mainly export products and provide services (of Armenian origin) to the Russian market the export receipts thereof are in Russian rubles. This would negatively affect the economic growth of Armenia, thus causing withdrawals of deposits from commercial banks. In this case, a deeper decline could be expected, however, that would not seriously hit the banking system of Armenia. Meanwhile, if the citizens of Russia who are connected with the banking system and/or the MOEX, or who still have savings in foreign currency kept at home for the worst days to come and due to other reasons and/or factors decide to move to Armenia as an alternative location, the capital inflow would be reported that could compensate the decline in the banking deposits that we expect due to the appreciation of the Armenian dram against the Russian ruble. Hence, even an increase in banking deposits would be reported in December 2024 (y/y) and could come close to 6.0 trillion Armenia drams. In 2025, the changes in the deposits could be explained by the economic growth prospects of Armenia, and if the capital outflow is reported or not (the outflow of the capital that Armenia could have received in 2024 owing to the Western sanction becoming effective on 12 June 2024).

Authors: Anna Makaryan, Ph.D., Diana Matevosyan, Hamlet Mkrtchyan, Nexus Intellect Research NGO

Chief Research Officer: Verej Isanians, Ph.D., Nexus Intellect Research NGO

[1] End of period.

[2] December 2021=100. Consumer price index (CPI) adjusted.

[3] Respective exchange rates of the US dollar against the Armenian dram in December 2021 (end of period): 480.14 AMD; December 2022: 393.57 AMD; December 2023: 404.79 AMD; April 2024: 388.

[4] Reported and expressed in Armenian drams. Note: most deposits are in foreign currency, namely in the US dollars

[5] Source: Central Bank of Armenia (CBA). Authors’ calculations. If not stated otherwise the source of all data (online databases, various publications) is the CBA.

[6] Source: Authors’ calculations based on the data released by the Statistical Committee of Armenia.

[7] December-over-December

See Also

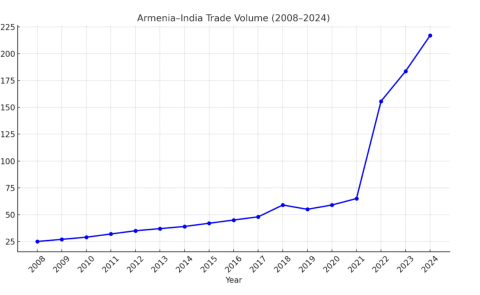

Armenia and India: Building New Bridges in Trade and Strategy

Between Tehran and Tel Aviv: Azerbaijan’s Neutrality Dilemma Amid Rising U.S.-Israel Tensions with Iran

From Neorealism to Neoliberalism: Armenia’s Strategic Pivot in Foreign Policy After the Nagorno-Karabakh Conflict

Georgia and Russia: New Turn in Bilateral Relations