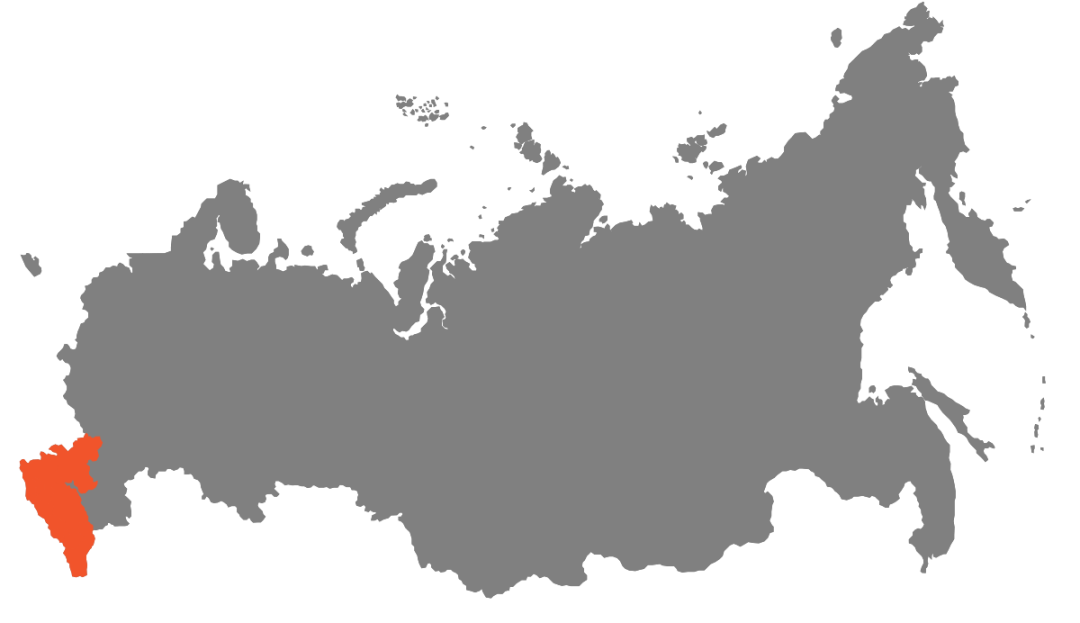

Study Reveals Potential for Industrial Complex Development in North Caucasus

Experts from the North Caucasian Federal University (NCFU) analyzed the potential for the development of the industrial complex in the subjects of the district. The study covers the period of 2021-2022.

According to NCFU Rector Dmitry Bespalov, the subjects of the macroregion have a high economic potential in terms of mining, food industry, chemical industry, and pharmaceutical industry. In the North Caucasus Federal District during 2021-2022, industrial production increased by 2.7%. During 2022, industrial production rose in Dagestan (+8.5%), North Ossetia (+6%), Ingushetia (+10.8%), Karachay-Cherkessia (+5.6%), Chechnya (+5. 6%), Kabardino-Balkaria (+2.1%). Incomes from industry in the North Caucasus Federal District account for more than 30% of the region's gross value added. Extraction of minerals, production of petroleum products, production of food products, chemical, and metallurgical products, engineering, and production of building materials, to a large extent, support the employment of the population and lead to tax revenues in the treasury of the subjects.

The structure of the manufacturing industry of the district is dominated by the production of food and beverages (35%), as well as the production of chemical products, medicines, and materials used for medical purposes (29%). Regarding mining, 68% is oil and natural gas, 16.5% is providing services in the mining field, 9.4% is the extraction of other minerals, and 5.9% is the extraction of metal ores. "In the North Caucasus Federal District, the leader in all industrial production sectors is the Stavropol Territory. More than 70% of the industrial production of the North Caucasus is concentrated in the Stavropol Territory. In other regions of the Okrug, small and medium-sized businesses, including those within the shadow sector of the economy, occupy a decisive place in the development of industry," the study added. The balanced financial result (profit minus loss) of the activities of the North Caucasus Federal District organizations in 2022 (excluding small businesses) amounted to 131,935 million rubles, which is 13,517 million rubles, or 11.4% more than in 2021. At the same time, the share of unprofitable organizations reached a value of 24.2% (in 2021 -23.4%).

As noted in the study, 2022 has become one of the most challenging years for Russia from an economic point of view. Multiple sanctions have led to the disruption of integration and cooperation in international relations of domestic business structures, a serious transformation of logistics chains, and an outflow of foreign investment and international companies from the country. As a result, serious changes are observed in the economy of the regions, and new tasks and problems appear, including in industry. Most regions of the North Caucasus Federal District are energy deficient, and the state and features of the energy infrastructure are significant barriers to the dynamic development of the macroregion. "The fixed assets of industrial enterprises of the North Caucasus Federal District at the beginning of 2022 are worn out by 53.4% and require renewal. First of all, this concerns the Chechen Republic, the Republic of Dagestan, and the Stavropol Territory. The level of depreciation of fixed assets is especially high in such sectors of the macroregion as activities in the field of information and communications, mining, and manufacturing industries (the degree of depreciation of fixed assets is 68.7%, 60.8%, 53.9%, respectively)," the study stressed.

Among the negative factors hindering the development of industry in the North Caucasus Federal District, experts identified the low level of investment attractiveness of the regions, the high level of subsidization of most subjects, as well as dependence on the federal budget, insufficient synchronization of federal and regional mechanisms of state support, as well as the low level of development of areas of accelerated economic growth, industrial and technology parks. There is also stagnation of small and medium-sized businesses. NCFU experts also compiled the TOP-15 investment projects of the North Caucasus, which were in the active stage of implementation in 2022, whose products will contribute to the import substitution tasks in the country. The basis for ranking was the number of investments in rubles.

At the top of the list of investment projects of the district is the largest import-substituting industrial project in the North Caucasus Federal District, which the Stavropol Territory is implementing with Kabardino-Balkaria. The Tyrnyauz deposit is the largest in Russia and one of the largest in the world, which contains almost 37% of the tungsten reserves explored in the Russian Federation. The volume of the carbide tool market is estimated at EUR 167 million, and most of these funds are now received by foreign companies: imports account for 85.5%. According to the investment project passport, industrial capacities are supposed to be deployed at two investment sites - in Tyrnyauz (production for the extraction and enrichment of ore) and Nevinnomyssk (hydrometallurgical production). During the implementation of the project, an underground mine will be restored, and the associated environmentally friendly infrastructure will be built. The commissioning of the first production facilities is scheduled for the end of 2023 - the beginning of 2024.

Priority industrial investment projects also include the modernization of equipment for petrochemical production and gas processing "Stavrolen" (Stavropol Territory), the creation of production of building heat-insulating materials LLC "Stroyinvest-A" (Chechen Republic), the construction of a glass furnace for the production of one-stage textile fiber glass LLC "Kaspiysky glass fiber plant (Republic of Dagestan), the creation of an enterprise for the production of lighting products, the Zarya Ossetia plant (Republic of North Ossetia-Alania) and others. At present, the growth point for the economy of individual regions is the state defense order. For instance, there are 12 military-industrial complex enterprises in the Stavropol region. In Dagestan, the increase in defense orders in 2021 compared to 2020 was about 30%, which significantly affects the results of the socio-economic indicators of the territories.

See Also

Pashinyan and Mirzoyan Visit Georgia for Talks on Strategic Cooperation

Armenian Parliament Debates Transport Issues, Regional Projects, And Security Policy

Armenia Warns That Iran Tensions Are Negatively Affecting South Caucasus Development

Bulgaria Secures Nearly 40% Of Gas Demand Through Azerbaijan Deal