Armenia's Export Growth Potential Amid Russia's Possible Economic Decline

This article evaluates Armenia's export growth potential amid possible shifts in Russia, its leading trade partner. The study meticulously documents the substantial growth in Armenian exports of goods and services from 2021 to 2023, marked by a compound annual growth rate of 43.18%. The growth of services exports, particularly travel, is credited to an influx of Russian visitors and IT professionals after the onset of geopolitical tensions in the region. The paper identifies a significant surge in merchandise exports driven by re-exports, especially in high-tech goods under Chapter 85 of the Harmonized System, predominantly to Russia without violating Western sanctions as much as possible upon undergoing processing in the territory of Armenia. The article argues that the current growth patterns may face challenges due to the appreciating Armenian dram against the Russian ruble and impending political factors, highlighting Armenia's need to diversify its export markets, particularly towards the European Union. The study outlines potential export growth scenarios for Armenia in 2024 and 2025 based on the country's evolving political and economic landscape. The study underscores the urgency for Armenia to enhance the attractiveness of its tourism industry to non-Russian source markets and adhere to stringent production standards that cater to the Western and Gulf Cooperation Council.

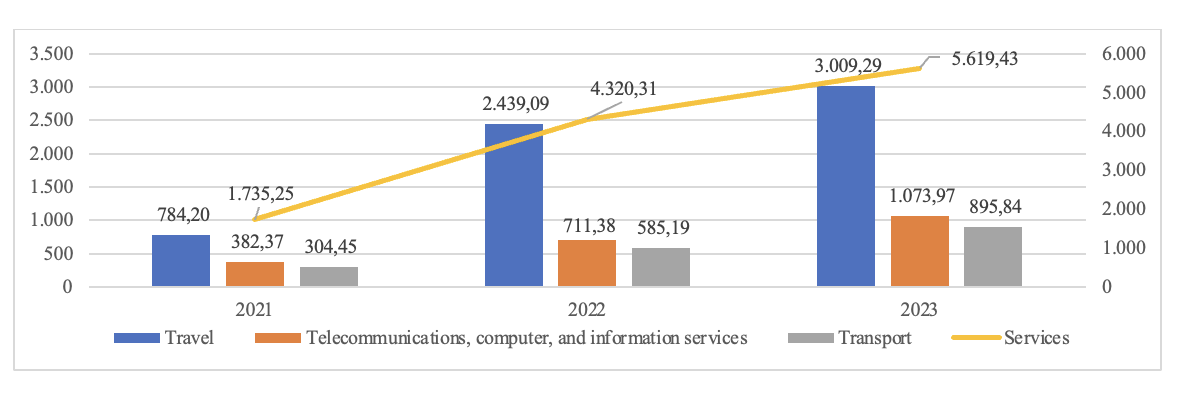

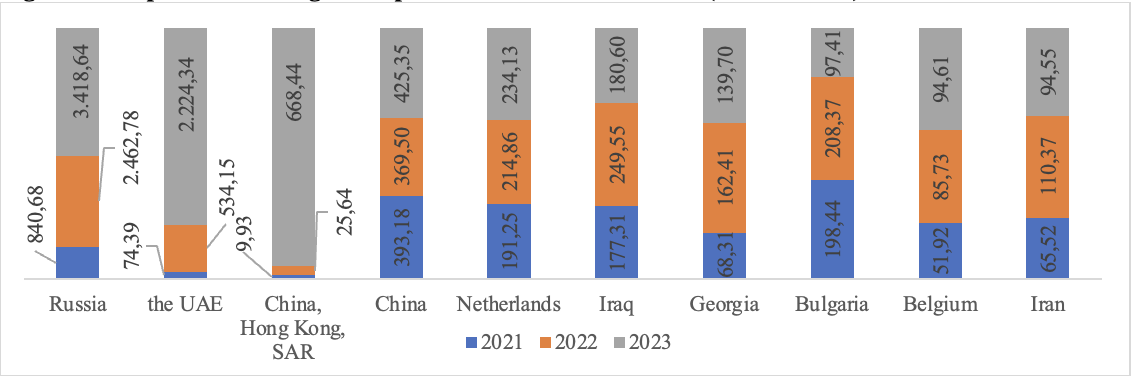

Background: The exports of goods and services grew at a compound annual growth rate of 43.18% from 2021 to 2023.[1] The services exports reached 5.6 billion US dollars (USD) in 2023 (see Figure 1). Meanwhile, the merchandise exports reported a gigantic increase from 2021 to 2023, amounting to 8.4 billion USD (see Figure 2). Exports of goods to Russia, the United Arab Emirates (UAE), and China’s Hong Kong skyrocketed in 2023 (with the latter two emerging as the top three leading trade partners for the first time). Exports to these three markets amounted to 6.31 billion USD, accounting for 75% of merchandise exports in 2023. However, we assume that the record trade values of the merchandise and services exports reported in 2023 (since the independence of Armenia from the Soviet Union back in 1991) could hardly be broken or envisaged in the medium term due to protracted appreciation of the Armenian dram against the Russian ruble and/or possible political factors. Therefore, we expect a decline starting from the second half of 2024 and accelerating in 2025. Hence, penetrating new export markets (especially the EU) would be pivotal in mitigating the Russian market's possible partial and/or complete loss and paving a path to a larger and richer market.

Source: SCA.

Overview of the growth of exports of services: In the case of services exports, the growth was mainly substantiated by the pivotal role of a single source market (Russia) since the citizens thereof were opting for Armenia as an attractive travel destination among a limited number of alternatives as a travel destination after the Russian-Ukrainian war had begun in February 2022. The expenditures of the international inbound visitors to Armenia accounted for 12.43% of the Gross domestic product (GDP) in 2023 and 53.65% of the services exports in 2023, thus peaking at 3.01 billion USD (see Figure 1). The increase in travel services was mainly driven by the influx of about 1.93 million tourists from Russia from 2022 to 2023 (351,801 Russian inbound visitors in 2021), along with the increase in tourist arrivals from other source markets.

The immigration of Russian high-skilled professionals (IT specialists) starting from February 2022 increased the workforce supply and contributed to higher value-added activities, thus generating additional export receipts for Armenia. Exports of telecommunications, computer, and information services increased from 2021 to 2023, contributing to the growth of the services exports and accounting for 19.11% thereof in 2023 (16.47% in 2022), thus surpassing one billion USD (see Figure 1). The inflow of Russian IT specialists, coupled with the Government's incentives program (adopted in 2020, however, becoming effective only in 2023 and ending at the end of 2024) aimed at attracting highly skilled professionals worldwide (namely graduates of top-ranked Universities) by offering partial salary compensation to employers[2], contributed to a growth in the number of professionals employed in the IT sector (overall, 11,357 specialists, including local counterparts), amounting to 31,902 employees in 2023.

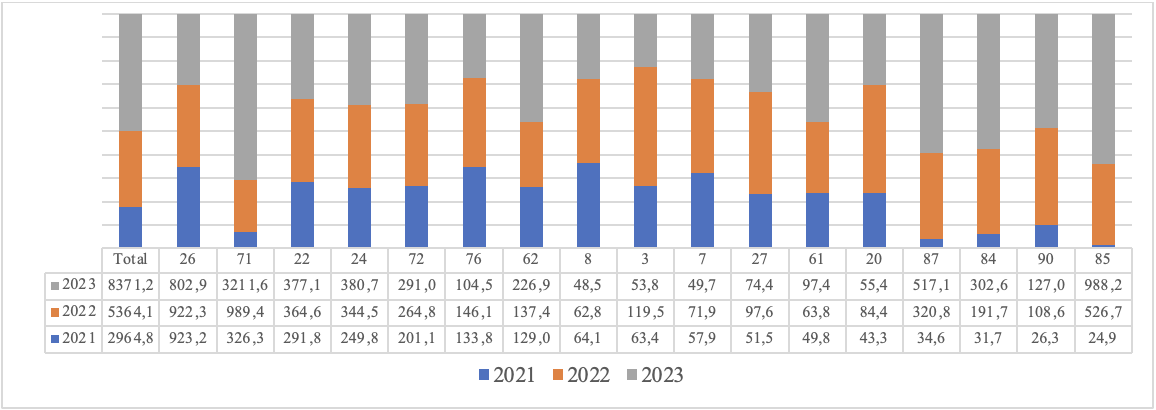

Figure 2.: Merchandise exports from Armenia according to major chapters (at 2-digit level) from 2021 to 2023 (million USD)

Source: UN Comtrade Online Database. Notes: Chapters of Harmonised Commodity Description and Coding System (HS) at a 2-digit level[3].

Overview of the growth of merchandise exports: The growth of merchandise exports was mainly driven by the re-export practices of a few chapters, upon undergoing processing in the territory of Armenia.[4] Chapters 84, 85, and 87: Upon importing from the rest of the world, the goods included mainly in these chapters were exported to Russia without violating the Western sanctions as much as possible und undergoing processing in Armenia.

Direct imports-reexports: Upon importing from the rest of the world, the goods included mainly in one chapter (HS codes 85) were exported to Russia without violating the Western sanctions as much as possible[5]. Armenia has never had a strong comparative advantage in producing and exporting those goods (as a country of origin), and the exports of those goods skyrocketed only after the Russian-Ukrainian war (see figure 2). In 2023, the manufacture of wiring devices industry in Armenia reported a 12.3-fold increase (y/y); manufacture of electric motors, generators, and transformers increased 13.1 times (y/y); installation of industrial machinery and equipment reported a 97.4-fold increase (y/y), etc. In the case of Chapter 85, Armenia mostly imported goods and items from Vietnam and China from 2022 to 2023. Imports from Vietnam skyrocketed and amounted to about 723 million USD in 2023 (139.06 million in 2022), while imports from China declined and comprised 375.36 million USD (400.13 million USD in 2022). In 2023, imports amounted to 1.41 billion USD, and exports of Chapter 85 reached 988.16 million USD (to Russia: 923.82 million USD, and to Belarus: 34.79 million USD). In the case of chapters 84 and 87, exports-to-imports ratios were far lower than that of Chapter 85 (29.12% and 34.36%, respectively, compared to 69.85% in 2023). Although re-export practices could be traced in chapters 84 and 87, exports-to-imports ratios were far lower than that of Chapter 85 (29.12% and 34.36%, respectively, compared to 69.85% in 2023). Again, in the case of Chapters 84 and 87, Armenia never had a strong comparative advantage in producing items included in both chapters.

Chapter 71: Especially in 2023, upon importing goods mainly included in Chapter 71 from Russia, these goods underwent some processing on the territory of Armenia and then were reexported to mostly two major markets (the UAE and Hong Kong). The manufacture of jewelry and related articles industry reported an about 5-fold increase (y/y)[6] in 2023 (the diamond cutting and processing industry grew at about 41.4% (y/y), while the manufacture of jewelry sector reported an about 32-fold increase). Based on the performance of this industry, we could assume that some of the gold imported underwent processing and was exported in the form of jewelry, and imported diamonds were cut and polished in Armenia as well, thus generating value added in Armenia. The imports of Chapter 71 amounted to 2.30 billion USD, and exports reached 3.21 billion USD in 2023.

Figure 3.: Exports to leading trade partners from 2021 to 2023 (million USD)

Source: SCA

Specifics of merchandise exports to Russia and the role of imports from Russia in exports to other countries: The growth of merchandise exports to Russia was mainly driven by reexports from 2022 to 2023, upon undergoing processing in Armenia. Meanwhile, Chapters (3, 7, 8, 22, etc.) that were traditionally exported to Russia even before the Russian-Ukrainian war began (products mainly included in these chapters were of Armenian origin, and the exports thereof were primarily exported to Russia) reported a decline in 2023 compared to 2022 when an increase was reported. The drop in 2023 was substantiated by the significant appreciation of the Armenian dram against the Russian ruble in 2023 (28.09% (y/y))[7] since the export receipts were mainly in Russian rubles, hence, if the appreciation of the Armenian dram against the Russian rubble persists in 2024, it would hardly hit the exports to Russia, mainly in cases of products of Armenian origin. Since enough efforts have not been made to produce most items for export to Russia according to the rigorous standards to comply with the EU directives, Armenian businesses would have difficulties in finding new markets.

By excluding reexports, we identified that the exports of goods of Armenian origin to Russia could hardly comprise one-third of the exports to Russia in 2023. This stresses the importance of market diversification to ensure higher export earnings and avoid possible sanctions that Russia could impose owing to political tensions between Armenia and Russia. In 2023, if Armenia had not exported and imported from Russia (including for processing and re-exporting, and direct re-exporting), Armenia’s exports to the world could hardly have reached 3 billion USD.

Possible scenarios of export growth for 2024 and 2025

Geopolitical factors resulting in the loss of the Russian market: If political relations between Russia and Armenia become tense, that could result in breaking all economic ties in the second half of 2024 (imposing sanctions on Armenian exports and/or closing borders for Armenian trucks transporting goods, and forbidding Russian tourists to visit Armenia, etc.), regardless the macroeconomic stance in Russia and continued appreciation of Armenian dram against the Russian rubble could seriously hit the Armenian economy. At least a two-digit decline could be reported in the exports of services and goods (in the case of merchandise exports, even a 2-digit decline could be expected), thus translating into an economic downturn in 2024. In the case of services exports, the tourism industry would be seriously hit, affecting the economy due to the “multiplier effect”[8] unless Armenia manages to attract non-Russian tourists, especially from the EU and the Gulf Cooperation Council (GCC) countries, to mitigate the decline which would be inevitable in 2024. Otherwise, a 2-digit economic downturn could be expected. The loss of exports of goods (of Armenian origin) would seriously hit agriculture and manufacturing (namely food processing) since the sudden and abrupt loss of the market would find the Armenian businesses unprepared to channel these goods to markets that adhere to the Western rigorous standards. The decline in manufacturing and agriculture, coupled with the poor performance of the tourism industry, would cause a two-digit economic decline. Under this scenario, the role of the government would be crucial to assist the companies in starting production and exporting goods in compliance with Western standards and initiating programs to promote exports to new destinations. The magnitude of the decline of services and merchandise exports in 2025 mostly depends on how successfully the government will assist and coordinate the required measures to channel these products and penetrate new markets (source) to start overcoming the economic recession expected in 2025 under this scenario.

Prolonged appreciation of the Armenian dram against the Russian dollar might result in a partial loss of the Russian market: Although according to the IMF[9] the growth of the Russian economy is forecasted for 2024-2025, and the growth of services and merchandise exports will primarily depend on how much the Armenian dram appreciates against the Russian ruble in the second half of 2024 that we expect, which will determine how severe the decline in exports of services and goods will be. Under this scenario, a 2-digit decline in the exports of services and merchandise exports (namely products of Armenian origin while the re-exports (exports of items upon undergoing processing in the territory of Armenia) might not be affected drastically) could be expected, thus resulting in an economic downturn (a single-digit) in 2024. The tourism industry would report a serious decline in 2024 that would continue in 2025 as well at a lower rate. If the government of Armenia drafts and implements targeted strategies to attract non-Russian tourists in the second half of 2024 and throughout 2025, then these measures would allow Armenia to attract more Western travelers, especially from the EU and the GCC, to somehow reverse the continued downturn. The appreciated Armenian dram would put an additional burden on the exports of products of Armenian origin to Russia, thus causing a decline in exports and urging them to consider diversification options and negatively affecting the performance mostly of agriculture and manufacturing industries of Armenia in 2024 that would continue in 2025 as well. Here again, under this scenario, the government needs to proactively guide businesses to produce goods according to Western standards and promote exports to new markets (namely the EU and GCC region). The depreciation of the Armenian dram against the US dollar and the Euro would be considered an additional factor in promoting exports to the West and the GCC Region, along with the Government of Armenia playing a crucial role in ensuring upgrading in production in compliance with the rigorous standards in 2025. If these measures are in place, the economic decline won't be serious in 2025, close to 0%, and even a slight increase could be expected depending on the efforts of both the private sector and the government.

Authors: Anna Makaryan, Ph.D., Diana Matevosyan, Hamlet Mkrtchyan, Nexus Intellect Research NGO

Chief Research Officer: Verej Isanians, Ph.D., Nexus Intellect Research NGO

[1] Source: Statistical Committee of Armenia (SCA). Authors’ calculations. If not stated otherwise the sources of all statistical data (online databases, various publications) is the SCA.

[2] Source: Appendix No 1 to Government Decree No 355-L dated 26 March 2020 (changes dated 27 January 2022 (Government Decree N 106-L); 4 August 2022 (Government Decree No 1224-L)); 18 May 2023 (Government Decree No 831-L).

[3] HS chapters: 26: Ores, slag and ash; 71: Natural, cultured pearls; precious, semi-precious stones; precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coin; 22: Beverages, spirits and vinegar; 24: Tobacco and manufactured tobacco substitutes; 72: Iron and steel; 76: Aluminium and articles thereof; 62: Apparel and clothing accessories; not knitted or crocheted; 8: Fruit and nuts, edible; peel of citrus fruit or melons; 3: Fish and crustaceans, molluscs and other aquatic invertebrates; 7: Vegetables and certain roots and tubers; edible; 27: Mineral fuels, mineral oils and products of their distillation; bituminous substances; mineral waxes; 61: Apparel and clothing accessories; knitted or crocheted; 20: Preparations of vegetables, fruit, nuts or other parts of plants; 87: Vehicles; other than railway or tramway rolling stock, and parts and accessories thereof; 84: Nuclear reactors, boilers, machinery and mechanical appliances; parts thereof; 90: Optical, photographic, cinematographic, measuring, checking, medical or surgical instruments and apparatus; parts and accessories; 85: Electrical machinery and equipment and parts thereof; sound recorders and reproducers; television image and sound recorders and reproducers, parts and accessories of such articles.

[4] Note: in this section of the text the prime source of all data is the UN COMTRADE online database, if other source is not stated, namely the SCA

[5] A couple of companies registered in Armenia were put on the US sanctions list (secondary). Source: News.am, Link

[6] Note: year-over-year.

[7] Source: SCA

See Also

3+3 Initiative as a New Order in the South Caucasus

Economic Cooperation Between Armenia and Georgia: Potential and Challenges Ahead

Russia and Occupied Abkhazia: A New Type of Relations

Georgia and US: From Close Ties to Caution