Armenia's Energy Security and Regional Cooperation

Abstract: Armenia’s energy security is profoundly influenced by its regional dependencies and cooperation, particularly concerning natural gas imports from Russia and Iran. Despite advancements in renewable energy, notably a significant increase in solar power generation, Armenia remains heavily reliant on these external sources for its energy needs. The Energy Swap deal with Iran (between the Yerevan Thermal Power Plant and Iran) illustrates the interdependent energy dynamics, where Armenian-generated electricity is exchanged for Iranian natural gas. The dependence on single-source markets for energy supplies (natural gas and supplies for the Armenian Nuclear Power Plant from Russia) poses substantial geopolitical risks, threatening Armenia's energy stability. Concurrently, the development of the Caucasian Power Transmission Network aims to enhance regional connectivity and reduce reliance on Russian supplies, empowered by the construction of the Armenia-Georgia transmission line that is a critical step towards mitigating technical limitations and enhancing Armenia's access to the EU energy market. Yet, the country's energy security remains precarious, vulnerable to geopolitical disruptions that could lead to severe shortages, particularly during the winter heating season. The article projects two scenarios for 2024-2025: a realistic scenario with maintained supply chains and a worst-case scenario involving a potential Russian ban on gas exports. These scenarios underscore the critical need for Armenia to diversify its energy sources and strengthen regional partnerships to ensure a stable and resilient energy sector. By reducing its dependence on a single supplier and enhancing the resilience of its energy infrastructure, Armenia can better safeguard against geopolitical risks and ensure a more stable and sustainable energy future.

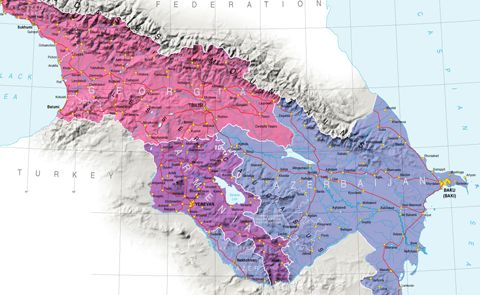

Background: As a country that lacks natural gas reserves, Armenia meets the domestic demand by importing natural gas from Russia and Iran (see Figure 1). The imported natural gas from Russia is intended for distribution to households, industrial organizations, the energy system (electric power), and other consumers. The natural gas imported from Iran is intended for electric power generation based on the Energy Swap deal between the state-owned Yerevan Thermal Power Plant (YTPP) and Iran (natural gas for electricity). Thermal power plants use natural gas to generate electric power which is an integral part of the energy portfolio of Armenia, however, the country doesn’t completely depend on natural gas supplies for electric power generation, with solar power generation on the rise.

Figure 1.: Imports of gas from 2017 to 2023 by markets (million cubic meters)

Source: Public Services Regulatory Commission of Armenia

The tremendous economic growth of 12.6%[1] (y/y)[2] reported in Armenia in 2022 upon the recovery from the aftermath of the COVID-19 pandemic translated into the highest level of electric power generation reported since 2017 and reaching 8.91 billion kWh (16.07% increase (y/y)) (see Table 1). In 2022, the growth in electric power generation was driven by the increase in nuclear and renewable power generation (less than 30 million watts) amounting to 1.05 billion kWh (18.33% increase (y/y)), namely solar power generation. In 2022, solar power generation increased by 169.33% (y/y) and further by 58.43% (y/y) in 2023 (see Table 1).

Despite the increase in renewable power generation, the dependence on a single source market for supplies (uranium for the power generation by the Armenian Nuclear Power Plant (ANPP) and gas to generate power by the thermal power plants) remained relatively high, thus making the stability of the Armenian electric power generation system and gas supplies vulnerable to geopolitical factors, leaving somewhat limited space for maneuvering in the short run (from 6 to 12 months), and especially during the heating season in winter to fully address the gas and electricity shortages without scheduled outages, etc.

Table 1.: Electric power generation by plants and types of power from 2017 to 2023 (million kWh)

Source: Public Services Regulatory Commission of Armenia

Dependence on Russian Supplies:The main players in the energy portfolio of Armenia are the Armenian Nuclear Power Plant (ANPP) with 407.5 MW capacity, Gazprom Armenia with a capacity of 440 MW, ArmPower with a capacity of 254 MW, and the Yerevan Thermal Power Plant with a capacity of 230 MW[3]. In the period 2017-2023, the share of the electric power generated by the ANPP accounted for 30.7% of the total electric power generated in Armenia, on average, meanwhile, the share of thermal power using imported natural gas supplies in the total power generation amounted 41.71%, on average (see Table 1). Over the same period, the Hydropower Stations ensured 15.41% of the electric power generated in Armenia (in 2023: 11.14%), with the share of renewable power generation reaching 12.04% (in 2023: 12.87%) (see Table 1).

It is interesting to note that gas imports from Russia, despite a significant increase in electric power generation in Armenia in 2022 (y/y) (see Table 1) as a result of the strong economic growth reported in 2022, didn’t translate in a proportionate increase in gas imports from Russia (see Figure 1); however, the gas volumes distributed to the various groups of consumers increased (see table 2). The increase in gas supplies distributed to the energy sector was the highest, growing at a compound annual growth rate of 10.73% (CAGR) from 2017 to 2023, followed by other groups of consumers (mainly greenhouses and services sectors) (see Table 2). The further appreciation of the Armenian dram against the US dollar and the Russian ruble[4], which started in 2022-2023, would make the Russian gas supplies more cost-attractive coupled with positive economic growth perspectives, thus making the dependence on a single supplier. However, the appreciation of the Armenian dram, the shift to electric cars (increase in imports thereof)[5], and the switching to liquified gas (increase in imports thereof)[6] caused a decline in the demand for the supplies of natural gas by car gas filling stations (CNG stations).

Table 2. The gas supplied via the distribution system (million cubic meters) to various groups from 2017 to 2023

Source: Public Services Regulatory Commission of Armenia. Note: Compound annual growth rate

The current trend pattern indicates that Armenia is still highly dependent on supplies from Russia. This dependency is evident in the current electric power generating system's capacity and in meeting residents' growing demand for natural gas consumption. As a result, Armenia is vulnerable to geopolitical shifts, such as tense relations between Armenia and Russia, which could lead to an abrupt cutoff and ban on the exports of natural gas to Armenia and uranium required for the operations of the ANPP.

The rise of renewable power generation: The renewable energy generation sector of the economy is considered promising in attracting investors. In 2023, small hydropower and solar stations generated about 13% of the electric power generated in Armenia (see Table 1). This is a tremendous increase since 2017 (see Table 1), with solar power generation capturing the market share of small hydropower stations, although this network is expanding. Some players became quite aggressive in penetrating and capturing the share of established actors.

As of April 1, 2024, 190 licenses were granted by the Public Services Regulatory Commission to Armenian small HPPs to operate the plants and stations, with an annual average actual distribution (proper) of 925.5 million kWh (without 15 stations under construction). And respective licenses were provided to 65 renewable power generating stations (predominantly solar) operating in Armenia, with an annual average actual distribution (proper) of 383.2 million kWh (without 45 stations under construction)[7].

Overall, the rise of solar power generation is a positive phenomenon. Despite its seasonal nature (since the stations' operations directly depend on the weather conditions), it is an important alternative to thermal and nuclear electric power generation in Armenia.

Table 3. Exports and imports of electric power from 2017 to 2023 (million kWh)

Source: Public Services Regulatory Commission of Armenia

Current State of Regional Cooperation: Regional cooperation can ensure stability in times of uncertainty and adverse and force-major developments. However, Armenia's options in this respect could be improved. The energy system of Armenia is currently connected with the respective systems of Iran and Georgia. Natural gas is imported to Armenia through the same countries, with Georgia as a transit country for Russian gas supplies. The electricity trade with Georgia is seasonal, and exports are limited (see Table 3) and subject to various technical limitations. Therefore, the Caucasian Power Transmission Network (Armenia-Georgia transmission cable (line) substations) project is being constructed to address these limitations and allow access to the EU market to ensure diversification[8]. In the case of Iran, the Energy Swap deal between Armenia and Iran will be effective till January 2030. The YTPP supplies Iran with 3 kWh of electricity for one cubic meter of gas imported[9]. The Iran-Armenia gas pipeline started its operations in 2007; its diameter is 700 millimeters. It can supply up to 2 billion cubic meters of gas annually at the required pressure[10]. Armenia imported about 370 million cubic meters of natural gas from Iran in 2023 (see Figure 1) to supply the electric power generated in Armenia (1,095.6 million kWh (see Table 3)). However, this amount would not fully cover the growing consumption of natural gas by Armenian residents in the short run, if growing gas supplies are predominately aimed at increasing exports of electric power to Iran. The third electric power transmission cable (line) between Iran and Armenia is in the final construction stage and will be ready in the upcoming months. Hence, Armenia could double its exports of electricity to Iran, and imports of natural gas from Iran as well[11].

Possible Scenarios for 2024-2025: We expect two scenarios, the worst and realistic. Under the realistic scenario, we hope that the geopolitical developments will not terminate existing contracts with Russia for the supply of natural gas, that it will be renewed, and that the price will not be affected. Moreover, the supply of uranium would be fine as well. Under the worst scenario, we expect that Russia could ban natural gas exports to Armenia from November 2024-February 2025 for about 4-6 months. The choice of the period can be substantiated by the following: the Hydropower plants, small hydropower stations, and solar photovoltaic stations (of the older generation) cannot operate at their total capacity (in terms of a relatively low efficiency), coupled with the fact that the heating season approaches, thus further exacerbating the situation for the Armenian consumers. . Under this scenario, the Government of Armenia could rely on the operations of the ANPP and the thermal power plants, the supply of natural gas from Iran, and the Armenia-Georgia 220 kW high voltage electric power transmission cables. In terms of electric power generation possibilities, the primary demand for electricity could be met via the electric power generated by the ANPP and thermal power plants, and the deficit could be covered with the electric power imported from Iran and Georgia via the Armenia-Iran and Armenia-Georgia power transmission cables. The gas distributed to the residents could be covered with gas supplies stored at the respective reservoir (underground storage station)[12].

Along with the increase in electric power supplies imported from Iran and Georgia, the thermal power stations could utilize the imported Iranian gas less and less, partially channeling it to the storage station to fill the reservoir. In this way, Armenia could avoid scheduled outages. However, we do admit that overcoming the Russian ban is only possible if the latter does not force Iran and Georgia not to cooperate with Armenia and assist in its efforts to cope with the adverse effects of the imposed ban. If Russia imposes a 12-month ban, Armenia could only mitigate the negative impact with assistance from its neighboring nations, namely Iran and Georgia.

Authors: Anna Makaryan, Ph.D., Gayane Salnazaryan, Ph.D., Aram Tadevosyan, Diana Matevosyan, and Hamlet Mkrtchyan, Nexus Intellect Research NGO

Chief Research Officer: Verej Isanians, Ph.D., Nexus Intellect Research NGO

[1] Source: Statistical Committee of Armenia (SCA).

[2] Year-over-year.

[3] Sources: Hrazdan Thermal Power Plant, Link; ArmPower, Link.

[4] Source: Central Bank of Armenia.

[5] Source: UN Comtrade Database.

[6] Source: Ibid.

[7] Source: Public Services Regulatory Commission of Armenia

[8] Sources: 1lurer.am, Link; the Ministry of Territorial Administration and Infrastructure of Armenia, Link.

[9] Source: azatutyun.am, Link.

[10]Source: civilnet.am, Link.

[12] The underground gas storage station with a capacity of about 130 million cubic meters. Source: Sputnik Armenia, Link.

See Also

From Neorealism to Neoliberalism: Armenia’s Strategic Pivot in Foreign Policy After the Nagorno-Karabakh Conflict

Georgia and Russia: New Turn in Bilateral Relations

3+3 Initiative as a New Order in the South Caucasus

Economic Cooperation Between Armenia and Georgia: Potential and Challenges Ahead