Russian Tourist vs. Western Visitor (EU): Balancing Armenia's Tourism Strategy

The aftermath of the Russian-Ukrainian conflict and the resulting international sanctions have reshaped the flow of Russian tourists, with many opting for destinations like Armenia, which offered a neutral stance at the beginning of the war, coupled with the pivotal role of familial ties, namely Diasporan tourists staying longer and spending less. On the other hand, Western tourists, particularly from the EU, prefer shorter stays but with higher daily expenditures, influenced by stronger currencies. This comparative analysis highlights the unique market dynamics and opportunities and underscores the broader implications for international tourism. By understanding these dynamics, stakeholders in the tourism industry, both in Armenia and worldwide, can better tailor their strategies to accommodate the nuanced needs of the diverse tourist groups, namely from the Western countries, and particularly the EU, to navigate through the risks associated with the Russian economy and benefit from the opportunities of major source markets.

Upon recovering from the aftermath of the COVID-19 pandemic, the tourism industry was among the fastest-growing industries in Armenia from 2021 to 2023. The accommodation and food service activities sector of the economy was growing at a compound annual growth rate of 18.40%[1] in the period 2021-2023. In 2023, tourist arrivals exceeded 2 million (reaching 2.32 million), while expenditures by international inbound visitors in Armenia surpassed 3 billion US dollars (USD), accounting for 12.43% of the gross domestic product (GDP). Compared to 2021, tourist arrivals more than doubled (2.65 times) in 2023, thus translating into a huge increase in expenditures by international inbound visitors by 2.23 billion USD. In the first quarter of 2024, tourist arrivals declined by 3.16% (over the same quarter of 2023)[2]. However, we assume this growth pattern reported from 2021 to 2023 could hardly be sustained in 2024 and over the medium term.

Growth sustainability concerns: The tourism industry's growth was driven by an influx of international inbound visitors from Russia. Compared to 2021, the number of tourist arrivals from Russia more than doubled in 2022 and amounted to 0.79 million visitors. From 2022 to 2023, 1.93 million Russian tourists visited Armenia (1.14 million in 2023). A rather hostile attitude towards Russians abroad starting from March 2022 substantiated the choice of Armenia (mostly neutral attitude) as a tourism destination for Russian citizens after the Russian-Ukrainian war began in February 2022, coupled with difficulties in being granted a travel visa to Western countries, namely the European Union (EU). The influx of Russian visitors was accompanied by an increase in tourist arrivals from the rest of the world in 2022 (67.04% (y/y)), which continued in 2023 (34.45% (y/y)) as well (in the case of the EU as a source market: 81.91% (y/y) in 2022, and additionally by 40.69% (y/y/)) in 2023 and amounting to about 165,000 travelers).

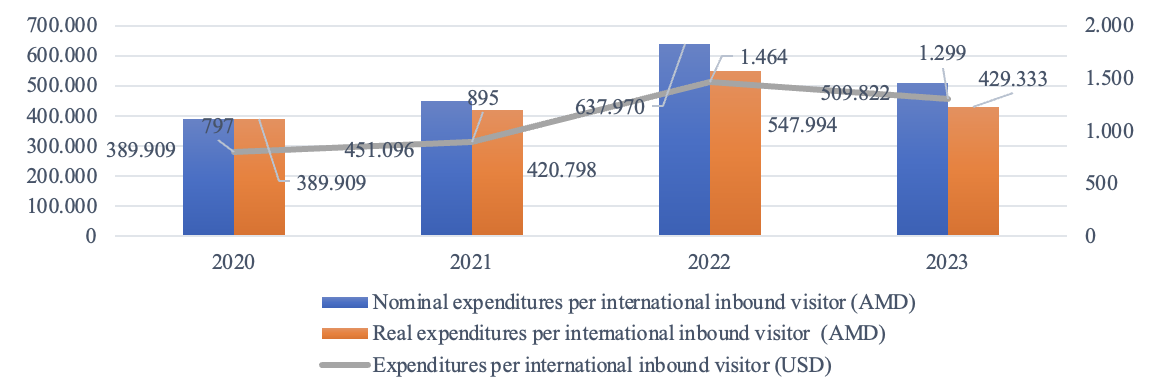

It is noteworthy to mention that the appreciation of the Armenian dram (AMD) against the US dollar in 2022 (13.52% (y/y[3])) that persisted throughout 2023 (9.91% (y/y)) and against the Russian rubble, especially in 2023 (28.09% (y/y)), did not stop Russian visitors from coming to Armenia. The Armenian dram appreciated against the Euro as well (in 2022: 22.75% (y/y); in 2023: 7.86% (y/y)). However, the appreciation of the Armenian dram negatively impacted the expenditures by international inbound visitors (per tourist) in 2023, reporting a real decline of 21.65% (see Figure 1), expressed in the AMDs ($1,464.34 in 2022, and $1,298.98 in 2023). The appreciation also negatively influenced the daily average expenditures of inbound visitors (per tourist) in 2023. The real decline amounted to 16.25% ($47.24 in 2022 and $44.79 in 2023). Indeed, it could affect the future growth of tourist arrivals from Russia in 2024 and onwards and other source markets.

Moreover, the appreciated national currency negatively affected the performance of the accommodation sector as well, thus reporting a decline of 5.20% (y/y) in 2023. However, the number of visitors who stayed at hotels (including hostels, B&B[4]s, health resorts, etc.) increased by 13.60% (y/y), reaching 0.73 million visitors and accounting for 31.64% of all tourist arrivals. This decline is associated with shorter stays in Armenia and the fact that travelers opted to stay with friends and relatives or rent apartments (55.20% increase in 2023 (y/y)).

Therefore, further appreciation of the Armenian dram against the US dollar could seriously hit the growth potential of the tourism industry, making Armenia less price-competitive than other travel destinations (especially in the case of the former Soviet Union countries (except the Baltic States) competing for Russian tourists with Armenia, since Armenia was among those three countries that reported the highest appreciation of national currency against the Russian ruble in 2023 (y/y) (along with the Georgia and Belarus[5]). In the first quarter of 2024, tourist arrivals from Russia declined by about 22.4% (over the same period in 2023)[6].

Figure 1.: Expenditures per international inbound visitor spent in Armenia from 2020 to 2023

Source: SCA. Note: Authors’ calculations. 2020=100

Hence, the macroeconomic stance in Russia would be a pivotal factor that would determine the future growth of the tourism industry in Armenia, at least in the short run and over the medium term, unless Armenia manages to attract more visitors from Western countries, namely from the EU (even for shorter length of stay). Therefore, if the appreciation of the national currency persists throughout 2024, only the increase in the number of Western visitors will compensate for the losses entailed by the possible partial loss of the Russian source market.

Profile of visitors from Russia vs. the tourists from the EU and the Western countries: The analysis of the latest visitor survey data (2019 Tourism Spotlight Survey)[7] stated that a steady inflow of visitors from Russia, the United States, and Iran was the backbone of Armenia’s tourism industry. Among them, the share of tourists from diaspora (visitors with Armenian ancestry) was substantial. Tourists from diaspora accounted for about 31% of all tourist arrivals; among them, the share of visitors from Russia and the United States was significant. Before the COVID-19 pandemic, an increase in the flow of visitors from Germany, France, and the Gulf Cooperation Council countries was reported.[8] Back in 2013, around 76.2% of all visitors from Russia were Diasporans (or 53.5% of all Diasporan tourists)[9]. This trend was reversed, and non-Diasporan travelers from Russia drove the growth of tourist arrivals, especially after the Russian-Ukrainian war.

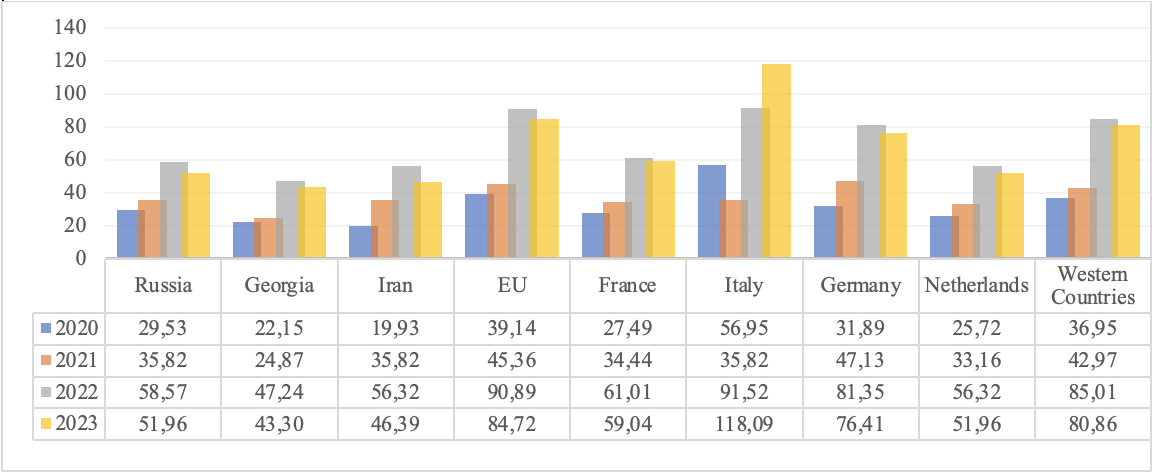

However, historically, the longer length of stay of Diasporans from Russia and living with relatives/friends and/or renting apartments[10] explains why the average length of stay is higher than that across the EU member-states (25 vs. 15.33 in 2023). The average daily spending of a Russian visitor was much lower than that across the major EU member states such as Italy, Germany, and France and was equal to the average daily spending of an average Dutch tourist in 2023 (see Figure 2). Such a high value of average daily spending by Italian visitors ($118.09 in 2023) is substantiated by a shorter length of stay (11 days in 2023) and the lower share of Diasporan visitors in total tourist arrivals from Italy compared to that from France and the Netherlands[11].

Figure 2.: Average daily spending in Armenia international inbound visitors (per tourist) from 2020 to 2023 (US dollar)

Source: SCA. Authors’ calculation[12]

The growth perspectives of the source markets: In the second quarter of 2024, it is predicted that the Russian rubble would slightly appreciate against the US dollar, then would depreciate in the second half of 2024, and would mainly continue throughout 2025[13]. This could translate into further depreciation of the Russian ruble against the Armenian Dram. According to the IMF forecasts, the real GDP of Russia will grow at 3.2% in 2024 (y/y) and at 1.8% in 2025[14]. This means that the decisive factor would be the depreciation of the Russian ruble against the Armenian dram, which would determine the increase in the inflow of Russian visitors into Armenia (non-Diasporan) from 2024 to 2025 unless the Armenian dram strongly depreciates against the Russian ruble.

According to the European Commission, in the EU, the growth outlook would be close to 1% (0.9%) for 2024 and economic activity expansion by 1.7% could be reported in 2025[15]. The Euro is expected to start depreciating against the US dollar in the coming months and would appreciate it in the coming years (according to ING)[16]. Again, in the case of EU member states, the Euro's depreciation will not be a critical factor in 2024 that travelers will consider when deciding to visit Armenia if the appreciation of the Armenian dram against the Euro doesn’t exceed 5-7%. If the Armenian dram depreciates against the Euro, it would be considered an additional incentive to consider Armenia as an attractive travel destination for visits. Moreover, in the case of Western travelers, namely the EU member-states, the increase in the number of visitors (namely the EU) could be affected by the strategies adopted by the Tourism Committee of the Ministry of Economy of Armenia to craft and implement targeted measures that would benefit Armenia’s tourism industry in 2025.

Possible scenarios of growth for 2024 and 2025[17]

2024: We do expect a double-digit decline in the number of tourist arrivals from Russia at about 30-40% (while the number of Diasporan travelers from Russia would be hardly affected), even though the Russian-Ukrainian war could end at the end of 2024 (and the West could lift the ban on issuing travel visas, and namely by the EU member-states). We expect that the number of tourist arrivals from the West and, namely, the EU will increase by about 30-40%. However, that would not be enough to compensate for the losses that the Armenian tourism industry would seriously suffer associated with the decline in the number of Russian visitors, especially in the second half of 2024.

2025: Again, we do expect a double-digit decline in the number of tourist arrivals from Russia at about 25-35%, accompanied by about 20-25% increase in the number of visitors from the West and, namely, the EU member-states. Again, the tourism industry could report a decline unless the number of visitors from the rest of the world increases drastically (namely from the Gulf Cooperation Council countries, especially the United Arab Emirates).

Strategy options: The Tourism Committee of the Ministry of Economy of Armenia must design and implement more aggressive targeted measures aimed at each source market in cooperation with tourism industry representatives to attract more visitors from the West, namely from the EU and the Gulf region. This measure would translate into positive gains for the industry from 2025 onwards.

Authors: Anna Makaryan, Ph.D., Diana Matevosyan, Hamlet Mkrtchyan, Nexus Intellect Research NGO

Chief Research Officer: Verej Isanians, Ph.D., Nexus Intellect Research NGO

[1] Source: Statistical Committee of Armenia (SCA). Authors’ calculations. If not stated otherwise the sources of all statistical data (online databases, various publications) is the SCA.

[2] Source: Tourism Committee of the Ministry of Economy of Armenia (TCMEA)

[3] Note: year-over-year.

[4] Note: Bed and breakfast

[5] Source: Exchange-rates.org., Link. X-RATESTM, Link, Ratestats.com, Link. Authors’ own calculations

[6] Sources: TCMEA, SCA

[8] Ibid.

[9] Source: USAID EDMC Project, Link

[10] Source: USAID EDMC Project, Link

[11] Ibid.

[12] Notes: Although we do admit that daily average expenditures by inbound visitors could vary across various groups of tourists (by purpose of visit (leisure, culture, visiting friends and relatives, etc.), by ancestry (Diasporan vs. non-Diasporan)) within each group of the given source market, however, for the purpose of the calculation, we assumed that the share of expenditures by international inbound visitors of each source market was proportionate to the share of tourist arrivals of that country in total arrivals (due to lack of data). By calculating the expenditures by the inbound visitors from each source market (per tourist), we divided these values by the average length of stay per each source market. This approach allows us to gain an insight into how daily expenditures vary across many source markets. We included the following major source markets into a group of Western Countries: the EU member-states, the United Kingdom, the United States, Canada, and Australia.

[13] Source: ExchageRates.org.uk, Link.

[15] Source: the European Commission, Link

[17] Note: The scenarios do not anticipate that any force major circumstances could be reported (global pandemic, possible war in the Caucasus region, etc.)

See Also

NATO and the South Caucasus: Lack of Vision or Strategic Withdrawal?

Georgia in 2026: Between Great-Power Fault Lines and Internal Fractures

U.S.–Armenian Relations Amid Shifting Power Dynamics: Expectations and Challenges

Ukraine War’s Spillover in the North Caucasus