Contrary to All Expectations: Armenia and Georgia Experience Economic Boom

About author: Svenja Petersen is a political economist who graduated from SciencesPo Paris, the Free Univeristy of Berlin, The London School of Economics and The College of Europe in Natolin. She currently works in the field of international development cooperation and is a freelance political analyst for several media outlets.

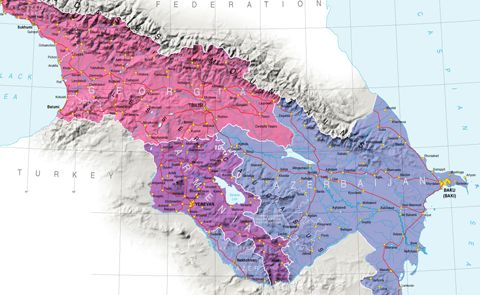

When Russia invaded Ukraine in February 2022, the economic outlook for Armenia and Georgia was bleak. The South Caucasian republics of Armenia and Georgia have close economic linkages to the Russian economy. Russia is the largest trading partner of Armenia and the second-largest trading partner of Georgia, despite Georgia’s official ambition to seek the EU and NATO membership.

After the Russian army's full-scale invasion of Ukraine and the imposition of comprehensive sanctions by the West against Russia, the economic forecasts for Armenia and Georgia looked similarly gloomy.

The Armenian diaspora in Russia comprises between 1.7 million and 2 million Armenians. Their remittances and those of Armenian seasonal workers returning to their homeland accounted for a full 5% of Armenia's GDP before the Russian army invaded Ukraine. The concern was that if the economic situation in Russia collapsed, there would be significantly fewer remittances to Armenia, thus weakening the Armenian economy substantially.

Moreover, Armenia is part of the Russian-dominated Eurasian Economic Union. Similarly, there was apprehension that if the Russian economy were to deteriorate severely, the other EAEU states could be dragged into an economic slump as well. The Western sanctions against Russia adopted in 2014 already had a significant negative impact on Armenia's economy, notes Armenian economist and lecturer at the Armenian State University of Economics Suren Parsyan in an interview with Caucasus Watch. Consequently, he continues, Armenia had to fear a recession once again.

The Georgian diaspora in Russia is significantly less populous than the Armenian one. Estimates of the Georgian diaspora in Russia vary widely and cannot be clearly determined. The most realistic estimate is probably an approximate population of 450,000 Georgians living in Russia, although some estimates go as high as one million. Thus, total remittances from Russia to Georgia in the pre-war year 2021 are also lower compared to the ones to Armenia: they are estimated at about $411 million, which makes up only 18% of all remittances flowing into Georgia. Yet, Georgia still remains dependent on the Russian economy. This is mainly due to the fact that Georgian products are incredibly popular on the Russian market. Russia is only very close behind China as the second largest destination country for Georgian exports. Moreover, the Georgian tourism sector is highly dependent on Russian tourists: after Azerbaijan, Russia is the country of origin from which most international arrivals in Georgia come. It was expected that a weakened Russian economy would put less money into the pockets of its citizens, reducing the likelihood that they would be able to travel, thereby having a strong impact on the Georgian tourism and service sectors.

However, none of this happened. The worries were unfounded. Armenia's and Georgia's growth rates are higher than in the previous fifteen years. The World Bank records real economic growth of 11% of Armenia's GDP in 2022. For Georgia, this figure is 10.5% for the first half of 2022. Both the Armenian Dram and the Georgian Lari appreciated significantly after a brief collapse at the beginning of the war in Ukraine.

But where does this unexpected growth come from, which was hardly predictable at the beginning of the war in Ukraine?

A Controversial Source of Economic Growth

The answer to this question triggers mixed feelings because it is mainly Russian and Belarusian citizens leaving their home countries and resettling in Armenia and Georgia that are boosting economic growth. Their motives for emigration are heterogeneous. Some are fleeing the mobilization in Russia; others are afraid of the Putin/Lukashenko regime; others are simply trying to evade the sanctions and their negative effects.

Their arrival of Russian and Belarusian migrants is often a sensitive issue for the two South Caucasus republics, as it is driving up prices and segregating locals from city centers. Moreover, in both countries, which were occupied by Russia for centuries, there is an increasing rejection of Russification, especially among young people.

Armenia, a long-time ally of Russia, now has a complex relationship with that country. Russia is widely regarded as a guarantor and protector of Armenian security and territorial integrity. At the same time, Russia is fulfilling this role less and less. Following the outcome of the Nagorno-Karabakh War in 2020, which was detrimental to Armenia, many Armenians feel betrayed by Russia. This perception was reinforced when Armenia's internationally recognized territory was attacked by Azerbaijan in September 2022, and Russia, despite Armenia's proclamation of the CSTO alliance case, received no assistance from Russia or the CSTO. Russia’s popularity declined steadily over the last decade and is now lower than it has ever been since the end of the Soviet Union, yet the country’s security dependence on Russia remains.

In Georgia, the matter is even more charged because with the Russia-Georgia War of 2008 and the creeping occupation of Abkhazia and South Ossetia since then, Georgians feel threatened by Russia and are afraid that the Russian immigrants serve the Kremlin with a pretext to invade all of Georgia, as has been the case with Ukraine.

Despite all the doubts and possible dissatisfaction among the local population, arrivals of Russian and Belarusian citizens in both South Caucasus states increased significantly.

The National Bank of Georgia recorded around 50,000 Russian citizens and 13,000 Belarusian citizens entering Georgia in a "first wave of migration" from February to August 2022.

In a "second wave of migration", triggered by mobilization in Russia, approximately another 30,000 Russian citizens arrived in Georgia.

Most likely, the difference between the two migratory waves lies in the immigrants' occupations and levels of education. While in the first wave it were Russians and Belarusians who had an above-average salary and often worked in the white-collar sector, the second wave was mainly composed of men with a lower level of education and less income who were at risk of being drafted into the Russian army.

In our interview with Suren Parsyan, he notes that, until now, about 50,000 Russian citizens have settled in Armenia. In addition, between the outbreak of war in Ukraine and October 2022, 12,000 Belarusian citizens have immigrated to Armenia. The Armenian political scientist Eduard Antinyan also distinguishes between the two waves of immigration and notes that the two differ above all ideologically. The first wave is dominated by Russians who oppose the war for ideological reasons. However, the second wave is more composed of Russians who fear being drafted into the Russian army, he notes.

The German Economic Team (GET) conducted sample interviews with emigrated Russian and Belarusian citizens in Armenia and Georgia and found that a majority works in the IT sector. Their employers are often based abroad, in the US or the UK, which makes it easier for them to migrate to another country. A significant number of them have also found work in their new host countries - Armenia and Georgia. Parsyan notes that during this year, Russian relocators have opened about 5,000 businesses in Armenia, mostly in the IT sector. In January-August 2022, the Armenian IT sector grew by 32% - of course, Russian IT companies have their share. This year, the unemployment rate has decreased significantly.

In Georgia, 75% of all Russian and Belarusian citizens settle in Tbilisi, while another 24% in Batumi. On the other hand, in Armenia, numbers are very concentrated in Yerevan. Only a small minority resides in Gyumri.

The Impact of Russian and Belarusian Immigration on the National Economies of Armenia and Georgia

The data shows that these are Russian and Belarusian immigrants who, on average, have received a good education, often have foreign employers, receive a stable salary, and can afford to live in urban areas. Their financial capacity is often higher than that of the local population, which puts the countries of arrival at risk of an increased social divide. On the one extreme, those who financially benefit from Russian emigration into Armenia and Georgia, like landlords, store and restaurant owners, and tourism service providers, earn more money from an overall increased demand. At the other extreme, however, many low-income earners can no longer afford to live in their rent-out apartments or invest in the service and entertainment sectors. “The average nominal salary in Armenia increased by 16.4%, but the salary of civil servants increased by only 3.6%, that is; the standard of living of public sector workers decreased. That is, the economic benefits were distributed extremely unevenly and unfairly this year”, Parsyan adds.

Overall, however, the economies of Armenia and Georgia are growing thanks to the influx of Belarusians and Russians. Both countries are among the fastest growing economies this year. Yet, in their report, the National Bank of Georgia notes that only around 1.5% of the 10% growth in Georgia is directly attributable to Belarusian and Russian emigration. Yet, this figure only accounts for the net contribution of Russian and Belarusian migration into Georgia. Other factors, such as the sharply increased number of money transfers into Georgia, are not taken into account.

At the same time, the spill-over effect of immigration into other sectors as well as spending in the real estate sector provide for additional boosts of the national economies. If, for example, hotel owners and landlords in Armenia and Georgia can now spend more money because they have more income thanks to a higher aggregate demand from Russian immigrants, the economic growth will be booked in the sector where the extra money was spent. The reason for the additional spending that the Armenian or Georgian population can now afford, however, remains the additional economic output that Belarusians and Russians bring to Armenia and Georgia. Yet, these spill-over effects can hardly be calculated as a factor because the positive economic impact caused by Russian immigration is only indirect. Even if the spill-over effect is difficult to calculate, the following applies to Armenia and Georgia: the more money flows into one sector of the economy, the more money circulates in the entire economy and thus ensures growth.

However, it is not only the real estate, service, and tourism sectors that are benefiting from Russian and Belarusian emigration. Thanks to Russian and Belarusian immigrants to Georgia, an additional USD 1 billion is currently recorded in Georgian banks. For the case of Armenia, Parsyan also observes that “Russians bring their savings with them” to Armenia. He estimates that within 8 months of 2022, the volume of transfers from Russia to Armenia will have increased by about 3.5 times, to $2.8 billion USD. About 25,000 new bank accounts were opened in Armenia. This of course boosts the banking sector, but the money inflow is quite fragile. While it improves the current economic situation, it increases future risks to stability since there is a high chance that at some point these non-resident deposits will be withdrawn from the banks again. Hence, it is at the same time also a source of vulnerabilities for the banks, which limits the capacities of the banks to make use of these deposits to channel to loans.

Increased Trade Between the South Caucasus and Russia

In addition to Russian and Belarusian immigration to Armenia and Georgia, there is another factor that is boosting the economies of the two Caucasus republics: Except for Georgia’s alignment with the EU, UK, and US sanctions in the financial system, Armenia and Georgia have not imposed sanctions on Russia. On the contrary, trade between Russia and Georgia increased by 46% in 2022, whereas trade between Russia and Armenia increased by as much as 49%.

Since Russia is now largely cut off from Western markets, the demand for substitutions and the import of goods from other countries is increasing. According to the data, Armenia and Georgia are visibly benefiting from this situation. These circumstances also explain why Georgia, much criticized for not joining the Western trade sanctions regime against Russia, is sticking to its trade policy with Russia.

Secondly, another reason for increased growth and trade rates between the South Caucasus republics and Russia is that many Russian businesses have either relocated to Armenia and Georgia or have opened a second branch there. An increased number of Russian-owned businesses in Armenia and Georgia also boost trade between those two countries and Russia, thus contributing to overall higher growth rates.

Lastly, there are repeated allegations of sanction circumvention. According to these claims, Armenia and Georgia buy Western goods on the international market and possibly resell them to Russia, thereby increasing their state income from the resale. However, such allegations have remained unproven so far.

Yet, Armenia has a special role to play in these interrelationships. The country is part of the Eurasian Economic Union, which guarantees free movement of labor, capital, and goods between Russia and Armenia (and the other EAEC countries). At the same time, Armenia has trade agreements with the EU, the U.S., and other important economic players, which gives Armenia the role of a pivot between different actors. This confers an immense strategic advantage on the country but also eases the consequences of the Western sanctions regime against Russia and Belarus.

The Future Remains Unclear

All these factors indicate that Armenia and Georgia were surprisingly able to break away from the negative forecasts for their economies. They were even able to gain economically from the current global political climate. Nevertheless, the situation remains tense for Armenia and Georgia. In addition to negative externalities such as a growing social gap and increasing geopolitical risks (especially for Georgia),there is one big potential threat: instability.

The danger of instability stems from the unpredictability and volatility of economic growth based on immigration and a sanctions system between two actors.

That makes current growth rates unsustainable.

As Georgian economist Davit Keshelava notes in an interview with the German newspaper Frankfurter Allgemeine Zeitung, "Nobody knows how long they [Russians and Belarusians] will stay in the country". Nobody knows the outcome of the Russian war in Ukraine, but if the tide turns in such a way that Russians and Belarusians return home en masse and sanctions against Russia are lifted, there could be an unforeseen and sudden "recession shock" with a burst of the real estate bubble and an imploding banking sector. For such a scenario, the National Bank of Georgia is building buffers out of current inflows that can later be used to buffer the financial system.

Armenia is employing an alternative technique to avert this situation. Armenian economist Parsyan declares that the aim is to keep the newcomers in Armenia in the long run. Among the Russian citizens immigrating to Armenia are also many members of the Armenian diaspora in Russia, who are easy to integrate into Armenian society. Russians, too, have already applied for Armenian citizenship, which, incidentally, also allows one to be a dual citizen. However, it remains to be seen if this method will be successful, as its success depends on numerous factors. Armenia and Georgia's current economic growth is thus unsustainable, thus it is now important to develop sustainable economic strategies that could mitigate a possible recession shock.

See Also

From Neorealism to Neoliberalism: Armenia’s Strategic Pivot in Foreign Policy After the Nagorno-Karabakh Conflict

Georgia and Russia: New Turn in Bilateral Relations

3+3 Initiative as a New Order in the South Caucasus

Economic Cooperation Between Armenia and Georgia: Potential and Challenges Ahead